Looking for business funding to help you grow, pay for overheads, or consolidate debt? We’ll help you find a loan that suits your situation, by matching you with products from over 40 lenders.

Here's what business finance typically looks like:

Borrow from $2,000 - $2,000,000

Borrow from $2,000 - $2,000,000 Loan terms from 3 months to 5 years

Loan terms from 3 months to 5 years Weekly, fortnightly or monthly repayments

Weekly, fortnightly or monthly repayments Fixed interest rates from 7.99%

Fixed interest rates from 7.99% Interest rate tailored to your situation

Interest rate tailored to your situationIt takes only three minutes to enter your details so we can match you with our panel of lenders. No lengthy questions.

Our Lender Match technology matches you with quotes from multiple lenders, so you can pick the best product for your circumstances.

Once you’ve chosen your preferred quote, we’ll let you know what documents are required to complete your application.

Get approved and receive funds within 24 hours.

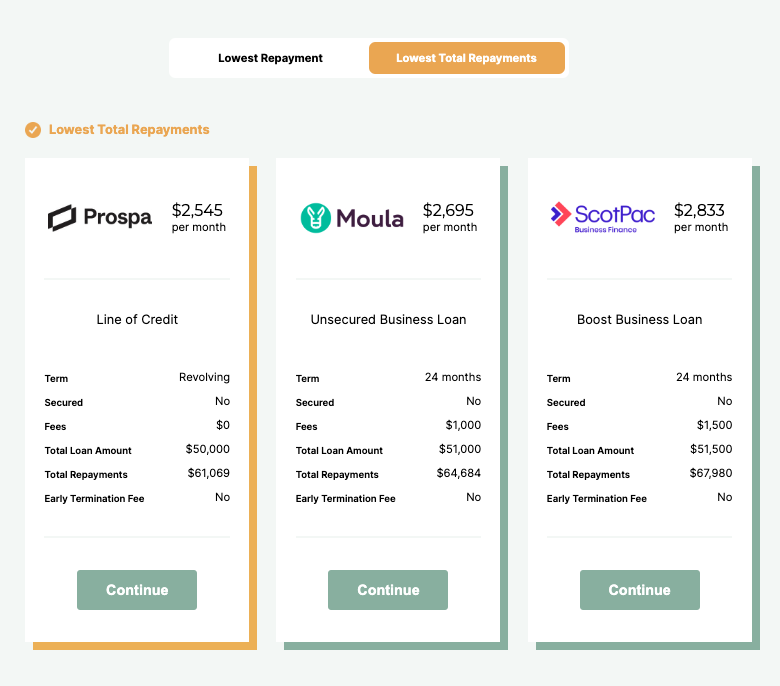

Here’s what your personalised quote will look like:

Emu Money proudly partners with over 40+ trusted Australian lenders, providing a robust and diverse lending platform. This extensive collaboration empowers us to offer a wide range of lending solutions, tailored to suit your unique financial needs. With Emu Money, you're tapping into a network of established financial expertise and reliability.

Compare over 40+ lenders with one application.

Business loans are a form of credit provided by financial institutions such as banks or private lenders to fund various business-related expenses. The funding could be necessary for buying machinery, expanding operations, funding new projects, or simply improving cash flow.

These loans are a critical financing tool for businesses of all sizes and types, including startups, SMEs, and large corporations. They come in various forms, including term loans, line of credit, invoice financing, and equipment loans. The terms and conditions, including interest rates, vary depending on the lender and the borrower's creditworthiness.

There are several types of loans in Australia that can benefit businesses in almost any situation, whether it is for growth, overheads, debt consolidation or working capital. Each of these loan types has its unique features, advantages, and potential disadvantages.

Here are the most common types of business loans:

A loan where borrowers offer assets as collateral to back the loan, typically resulting in better terms due to decreased lender risk.

| Amount | $5,000 - $2,000,000 |

| Term | 3 months - 5 years |

| Rate | From 7.99% |

| Eligibility | ABN, 6+ months in business, $5,000+ monthly turnover, asset backed |

| Time to Funding | 1 - 3 days |

Pros:

Usually offers lower interest rates.

Larger loan amounts are often available.

Cons:

Risk of losing the collateral if the loan is not repaid.

May require more paperwork and longer approval times.

Best for:

Established businesses that have valuable assets and require significant capital.

A loan without the need for collateral, based primarily on the borrower's creditworthiness and financial history.

| Amount | $2,000 - $1,000,000 |

| Term | 3 months - 5 years |

| Rate | From 7.99% |

| Eligibility | ABN, 6+ months in business, $5,000+ monthly turnover |

| Time to Funding | 24 hours |

Pros:

No collateral required.

Faster approval times.

Cons:

Typically higher interest rates.

Usually offers smaller loan amounts.

Best for:

Businesses with good credit history that need quick capital without risking assets.

A flexible loan arrangement allowing borrowers to draw funds up to a set limit whenever needed.

| Amount | $2,000 - $500,000 |

| Term | Revolving |

| Rate | From 13.95% |

| Eligibility | ABN, 6+ months in business, $5,000+ monthly turnover |

| Time to Funding | 24 hours |

Pros:

Flexibility to draw and repay as needed.

Only pay interest on the amount used.

Cons:

Higher interest rates than some other loan types.

Potential for over-borrowing.

Best for:

Businesses with fluctuating capital needs, such as seasonal businesses.

An extension of credit allowing businesses to overdraw their bank accounts up to a specified limit.

| Amount | $2,000 - $500,000 |

| Term | Revolving |

| Rate | From 13.95% |

| Eligibility | ABN, 6+ months in business, $5,000+ monthly turnover |

| Time to Funding | 24 hours |

Pros:

Provides a safety net for unexpected expenses.

Only pay interest on overdrawn amount.

Cons:

Higher interest rates than traditional loans.

Fees can accumulate if the overdraft limit is exceeded.

Best for:

Businesses seeking a cushion for their cash flow or unexpected expenses.

A loan designed specifically for the purchase of business equipment. The equipment often serves as collateral for the loan.

| Amount | $30,000 - $2,000,000 |

| Term | 2 - 5 years |

| Rate | From 7.99% |

| Eligibility | ABN, GST, 6+ months in business |

| Time to Funding | 1 - 3 days |

Pros:

Allows businesses to get the latest equipment without large upfront costs.

Potential tax benefits from depreciation.

Cons:

Risk of owning obsolete equipment.

Potential for long-term commitment for rapidly-depreciating assets.

Best for:

Businesses in need of expensive machinery or technology, such as manufacturing, medical or IT companies.

A mortgage solution for businesses to purchase or refinance commercial real estate.

| Amount | $100,000 - $2,000,000 |

| Term | 2 - 5 years |

| Rate | From 7.99% |

| Eligibility | ABN, GST, 6+ months in business |

| Time to Funding | 1 - 3 days |

Pros:

Helps businesses secure a physical location.

Potential asset appreciation.

Cons:

Significant down payment often required.

Risk of property value decrease.

Best for:

Businesses looking to buy, refinance, or expand their commercial premises.

A loan specifically tailored for small businesses, often with smaller loan amounts and shorter terms.

| Amount | $2,000 - $500,000 |

| Term | 3 months - 5 years |

| Rate | From 7.99% |

| Eligibility | ABN, 6+ months in business, $5,000+ monthly turnover |

| Time to Funding | 24 hours |

Pros:

Designed to meet the needs of small businesses.

Potential for government-backed guarantees.

Cons:

Smaller loan amounts compared to other types.

Might come with more stringent qualification criteria.

Best for:

Small businesses looking for capital to grow, cover operational expenses, or manage cash flow.

A loan intended to help new businesses get off the ground, often with special terms or requirements.

| Amount | $2,000 - $50,000 |

| Term | 3 months - 5 years |

| Rate | From 7.99% |

| Eligibility | ABN, 6+ months in business, $5,000+ monthly turnover |

| Time to Funding | 24 hours |

Pros:

Tailored for new businesses without financial history.

Can help validate a business idea or market.

Cons:

Higher interest rates due to increased lender risk.

Often requires personal guarantees or co-signers.

Best for:

New businesses that need capital to kickstart their operations and achieve initial growth.

Compare over 40+ lenders with one application.

Loans can serve a myriad of business purposes depending on your business needs. You can use the funds to purchase inventory, expand your existing business, acquire new equipment, hire more staff, or even pay for day-to-day operational expenses. Sometimes, businesses also take loans to refinance their existing debts or to fund research and development of new products or services. It's essential to carefully plan and allocate the borrowed funds to ensure they contribute to the growth and profitability of the business.

Here are some common reasons people take out finance for their business:

Business funding can be used to provide the initial capital needed to start a new business.

Business funding can help cover the costs of inventory purchases, ensuring a business has products to sell.

Whether it's machinery, IT equipment, or other tools, a loan can fund necessary equipment purchases.

When a business is ready to expand, whether by opening a new location or increasing production, a loan can provide the necessary funds.

Cash flow funding can help cover day-to-day operational costs such as utilities, rent, or payroll during lean periods.

To reach new customers and increase sales, business funding can be used to fund marketing and advertising campaigns.

Business debt consolidation loans can be used to consolidate multiple business debts into a single, more manageable payment.

Business funding can fund the costs associated with hiring new staff, including recruitment and training.

Business funding can fund the research, development, and launch of new products.

Business funding can provide a safety net of funds for unforeseen business expenses.

Ben Saddaris, Saddaris Imports

Industry: Wholesale

Challenge: Cash flow shortage due to late payments from customers.

Solution: Using an unsecured business loan to bridge the financial gap.

Facing a cash squeeze due to delayed customer payments, Ben risked missing new orders and eroding client trust. He turned to an unsecured business loan for a swift solution, which required no asset security and was funded within 24 hours. This timely intervention ensured Ben could restock without interrupting order fulfilment. Once the late paying customers had caught up, Ben was able to repay the loan in full, keeping their operations seamless and their client relationships intact.

The amount you can borrow depends on several factors. These include the loan type, your credit history, the financial health of your business, and the lender's terms and conditions. Lenders consider your business revenue, profitability, cash flow, and credit history to determine how much you can responsibly borrow and repay. A business with a strong financial track record and a solid credit rating is likely to be approved for a larger loan compared to a business with a weak financial profile.

The loan type also matters. For instance, equipment loans are usually for the exact amount of the equipment being financed, while a line of credit could be for any amount up to the maximum limit set by the lender. Some lenders offer smaller loans starting from a few thousand dollars, while others can lend several million. Before applying for a loan, assess your business needs and your capacity to repay to avoid overextending your financial obligations.

To estimate your monthly repayments and the total cost of the loan, input the loan amount, loan term and interest rate into the calculator below. This helps you plan your budget and choose the most suitable loan options.

Lenders consider several factors when assessing your eligibility against their credit criteria, including your credit score, income, debt-to-income ratio, age, residency, and required documentation. While meeting the eligibility criteria doesn't guarantee loan approval, having a good credit score, stable income, and a positive financial profile significantly improve your chances.

You are eligible to apply if you are:

Operating for at least six months

Operating for at least six months Minimum monthly turnover of $5,000

Minimum monthly turnover of $5,000 Registered for GST

Registered for GST Business owner is an Australian citizen or a permanent resident

Business owner is an Australian citizen or a permanent resident Business owner is over 18 years old

Business owner is over 18 years oldApply online and get a quote instantly! We'll match your loan application with products from over 40+ Australian lenders. Your quote will display all of the products you're eligible for, including repayment amounts, interest costs, fees or charges. You can then choose the product the best suits your needs and then we'll help you to complete the application process. Once the full application is submitted, normal credit approval processes can take anywhere from a couple of hours up to 2 days depending on the amount of information required.

If you’re eligible, and you are happy with the initial quote, you will need to prepare documents such as:

Passport or drivers licence

Passport or drivers licence Proof of income and expenses (e.g. payslips, bank statements)

Proof of income and expenses (e.g. payslips, bank statements) Details of any current debts or other loans

Details of any current debts or other loansSaving money on a business loan can have a significant impact on a company's financial health, providing more funds for growth and operations. One key factor to consider when trying to minimise costs is the loan term. Typically, a shorter loan term means higher repayment instalments but less interest paid over the life of the loan. For businesses with consistent cash flow that can handle larger repayments, opting for a shorter term can lead to significant savings in interest costs.

Conversely, a longer loan term often results in smaller, more manageable repayment instalments, which might be preferable for businesses wanting to maintain liquidity. However, it's essential to note that, over time, the total interest accrued on a longer-term loan can be considerably higher. Thus, while longer terms provide immediate relief in terms of cash flow, they might lead to higher overall costs in the long run.

Here's an example of how you could save $8,624 by picking a shorter term, on a $50,000 loan with a 7.99% interest rate:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

12 months | $4,349 | $52,190 |

24 months | $2,261 | $54,267 |

36 months | $1,566 | $56,397 |

48 months | $1,220 | $58,579 |

60 months | $1,013 | $60,814 |

With various loan options available, understanding their features is crucial to making an informed decision. Whether you're contemplating the type of security you'd need, the best interest rate structure, or the most suitable repayment schedule, you should carefully understand the nuances of each option to help you chart the best course for your business.

Here are some key considerations to keep in mind:

Secured loans require borrowers to pledge assets as collateral, ensuring lenders can recoup losses if defaults occur, often resulting in lower interest rates and better terms. On the other hand, unsecured loans are based solely on the borrower's creditworthiness, offering no collateral requirement but typically carrying higher interest rates, smaller loan amounts, and less flexible terms. Businesses should evaluate their financial situation and goals to choose between these options, ensuring alignment with their company's operational and financial direction.

Fixed term loans have set repayment durations, like 6 months or 5 years, where the entire loan plus interest is settled by the term's end. In contrast, revolving terms, commonly seen in business lines of credit or business overdraft, offer ongoing access to funds up to a defined limit, allowing businesses to draw beyond their account balance for short-term expenses. While fixed terms provide repayment certainty, revolving terms offer flexibility, letting businesses access funds as needed without seeking new loans, though careful monitoring is crucial to avoid exceeding the credit limit.

Unlike mortgages, loans for businesses are generally offered with a fixed rate. This means that throughout the term of the loan, the interest rate remains constant, providing businesses with predictability in their repayment schedule. On the other hand, a variable interest rate can fluctuate over time, typically tied to an index or a benchmark. While a variable rate loan might offer initial savings if market rates are low, it comes with the uncertainty of potential rate increases in the future. Before committing to either option, businesses should thoroughly review the product disclosure to understand the nuances of the rate structures and decide which aligns best with their financial strategy. If opting for a variable rate, it's essential to account for possible fluctuations during budget planning.

Understanding fees and charges associated with business finance is crucial to avoid unforeseen costs. While interest is a primary cost, lenders may charge application fees (typically $500 to $1,000), or more commonly, origination fees, which are for loan processing and range between 0% and 4% of the loan amount. Early termination fees can apply if a loan is settled ahead of its term, and may offset potential savings from early repayment. Additionally, lenders may charge direct debit fees per transaction ($2 to $4) and periodic fees for revolving term products, which could be fixed or percentage-based. If securing a loan, additional fees might apply. Thoroughly reviewing loan agreements is vital to understand the loan's true cost.

Lenders offer various repayment options to suit businesses' cash flow and operational needs, ranging from frequent daily or weekly schedules to less frequent fortnightly or monthly intervals. Many facilities feature fixed repayments, providing predictability in budgeting and ensuring businesses know the exact amount due at each interval. While this clarity aids in financial planning, it's crucial for borrowers to understand the total interest over the loan's term. Some may prioritise paying off loans quickly to minimise interest, while others might prefer longer terms for better cash flow management.

Dealing with Prospa was quick, polite and respectful. It was a really wonderful experience and I thoroughly recommend using them! All members I dealt with were super lovely and I felt like a valued cleint

Zalia

5 October 2023

Moula provided us a quick pain free solution to a short term problem. Nick gave excellent support and guided us through the process. Giving us a positive result in a short time frame.

Gregory Stallan

31 August 2023

Excellent service! Would recommend this company to obtain finance for your business.

LeanneS

28 August 2023

We have found Earlypay to be such a great system after years of being with another established debtor finance provider, the change was refreshing and rewarding, the fees were cheaper, the loan percentage higher and the system so much more intuitive. I highly recommend.

Camilla Nalder

8 July 2023

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.